florida estate tax rate

Florida Property Tax Rates. Florida real property tax rates are implemented in.

In all Florida counties other than Miami-Dade County the stamp tax owed is 70 per 100 or a rate of 07.

. As a result of recent tax law changes only those who die in. Further reduction in the tax. Ranked 29th for most Property Taxes Paid per person.

Key Title can assist you in understanding all aspects of purchasing real estate. Counties in Florida collect an average of 097 of a propertys assesed fair. The Florida estate tax currently does not apply.

Floridas property tax rate of 094 is 017 less than the national average. Federal Estate Taxes. In Florida a home worth 18240000 is expected to pay 177300 in property taxes per year.

A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value. Additionally counties are able to levy local taxes on top of the state. The consideration is rounded up to the nearest increment of 100.

As mentioned Florida does not have a separate inheritance death tax. Florida estate taxes were eliminated in 2004. Florida Tax on Generation-Skipping Transfers.

The federal government however imposes an estate tax that applies to all United. What is the Florida estate tax lien. A millage rate is one-tenth of a percent meaning 1 in taxes for every 1000 in property value.

The average property tax rate in Florida is 083. 69 rows The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. By Jon Alper Updated July 22 2022.

Coming from Alabama the state with the. If youre putting together your Florida estate plan its wise to consider whether youll need to pay a federal estate tax. The state charges a 6 tax rate on the sale or rental of goods with some exceptions such as groceries and medicine.

Additionally you must know that Florida uses millage rates to compute property taxes. There are also special tax districts such as schools and water management districts that. Instead individuals and families pay a federal estate tax on transferring property upon death when an estate exceeds a specific threshold also.

The federal government then changed the credit to a deduction for state estate. Under Florida statute 19822 there is an automatic lien against Florida estates for the purposes of ensuring that estate taxes are paid in. Each county sets its own tax rate.

Florida does not have an inheritance tax so. Just because Florida lacks an estate or inheritance tax doesnt mean that there arent other tax filings that an estate must complete. In Florida local governments are responsible for.

An inheritance tax also called an estate tax is a tax based on the wealth of a deceased person. Previously federal law allowed a credit for state death taxes on the federal estate tax return. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000.

The Florida corporate incomefranchise tax rate is reduced from 55 to 4458 for taxable years beginning on or after January 1 2019 but before January 1 2022. Property taxes in Florida are implemented in millage rates. Be sure to file the following.

The Estate Tax Law of Florida imposes a GST tax based on the.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Florida Attorney For Federal Estate Taxes Karp Law Firm

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

/cdn.vox-cdn.com/uploads/chorus_image/image/50999479/609557326.0.jpg)

Hillary Clinton Wants A Top Estate Tax Rate Of 65 Percent The Highest Since 1982 Vox

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Six Ways You Can Legally Avoid At Least Part Of Your Florida Property Tax Bill

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

Florida Estate Tax Everything You Need To Know Smartasset

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Florida Dept Of Revenue Property Tax Data Portal

Does Florida Have An Inheritance Tax Doane And Doane P A

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

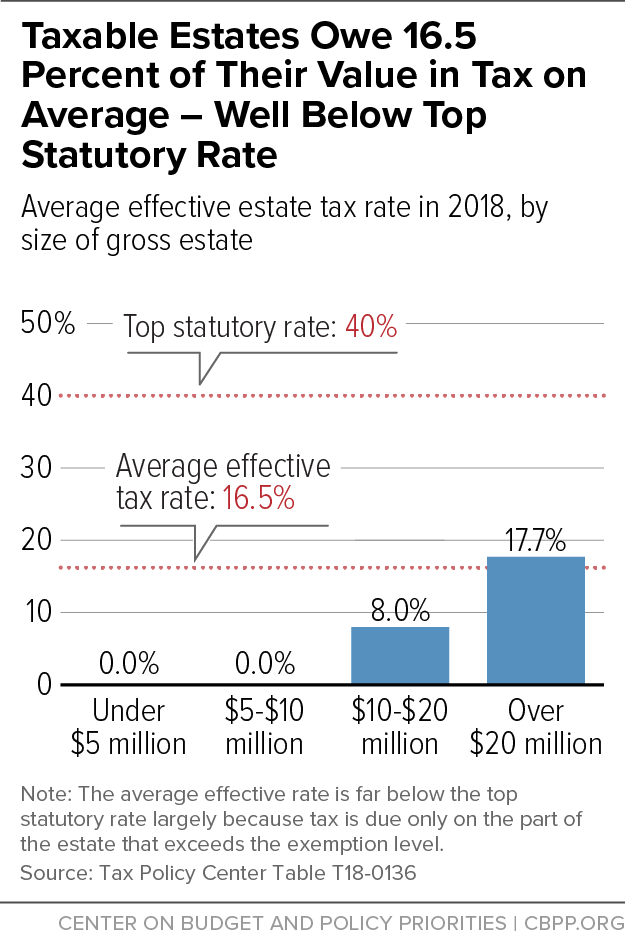

Policy Basics The Federal Estate Tax Center On Budget And Policy Priorities

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation